China’s YMTC Starts Producing Mysterious New Memory, Ups 3D NAND Prices

The Chinese company Yangtze Memory Technologies (YMTC) seems to be adapting to new US sanctions realities with a rather mysterious 3D NAND product that combines a relatively low storage density with an extremely speedy interface. In addition, YMTC has once again raised prices for its 128-layer 3D NAND by about 5%, according to DigiTimes. This move comes despite the ongoing slump in the PC and consumer electronics markets in general and the 3D NAND memory market in particular and follows a previous increase in May.

Mysterious New Product

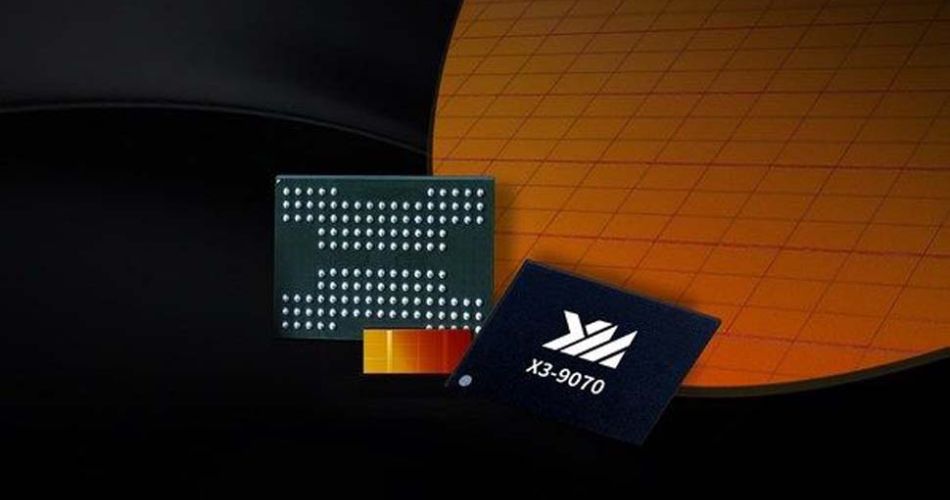

Although stringent U.S. export rules have hindered YMTC’s ability to produce 3D NAND flash chips with more than 128 layers, the company is swiftly adopting alternative strategies. In particular, YMTC has initiated large-scale production of its 128-layer NAND flash chips, dubbed ‘Wudangshan,’ that reportedly relies on the Xtacking 3.0 architecture, according to the report.

YMTC has productized a version of 128-layer flash before with its Xtacking 2.0 architecture, but the step up to the 3.0 revision marks a significant overhaul of an existing product, which normally wouldn’t take place. If true, the US sanctions, which hinder YMTC’s ability to make flash with higher layer counts, have spurred the company to re-vamp its older flash with performance-boosting tech. If such 3D NAND devices exist, they may combine relatively low storage density with high performance, which could be the company’s stop-gap solution before it comes up with a product that offers both high capacity and high performance.

The key point of Xtacking is to produce a 3D NAND array and various peripheral logic on separate wafers using the most efficient memory and logic process technologies in YMTC’s possession. Xtacking 3.0 introduces back-side source connect (BSSC) for the memory cell wafer, which simplifies production flow and reduces costs, according to TechInsights. YMTC developed Xtacking 3.0 for its 232-layer 3D NAND to bring together ultimate storage density (15.47Gb/mm2, according to Yole Group) and a 2400 MT/s interface, therefore offering perhaps the world’s best 3D NAND.

It is theoretically possible to add a CMOS wafer with high-speed peripheral logic to a 128-layer 3D NAND array wafer, but the question is whether it brings benefits for real-world applications because there is only so much one can do with a 128-layer process technology and 3D NAND device capacity from a costs perspective.

In fact, based on Yole Group’s findings, YMTC’s 232-layer 3D NAND uses string stacking to achieve 232 layers, with 128 layers on the ‘first deck’ and 125 layers on the ‘second deck’. From a manufacturing point of view, this means that the company may simply not add the ‘second deck’ to get to a 128-layer 3D NAND featuring the Xtacking 3.0 architecture. But, of course, this severely hurts the storage density of the final device and its competitive position.

Yet, it could make sense for the company to produce such memory if it wants to address specific applications and/or as a stopgap before it finds a way to add the ‘second deck’ without using equipment that it cannot procure or service.

YMTC has not formally confirmed the very existence of 128-layer 3D NAND with Xtacking 3.0 codenamed Wudangshan, so take the information with a grain of salt though.

5% Price Hike

YMTC recently raised its unit price for a 512Gb NAND device from $1.5 to $1.6, following an earlier hike from $1.35 – $1.4 in May. This pricing strategy contrasts with international NAND suppliers who are grappling with attempts to raise prices amidst tepid customer demand. But Yangtze Memory seems to be taking advantage of its position now that Chinese government agencies cannot buy memory from Micron.

DigiTimes claims that thanks to substantial financial backing from the China IC Industry Investment Fund (the Big Fund), YMTC is seeking solutions for upstream equipment and materials. While the report does not divulge whether YMTC is seeking to use domestically produced wafer fab equipment, it is certainly a possibility.

Apparently, the company’s stockpile of consumables, accumulated before the sanctions, is anticipated to sustain the mass production of 128-layer 3D NAND products for at least three more years, the report says. Meanwhile, it remains to be seen whether 128-layer 3D NAND will still be competitive three years down the road. Of course, the Chinese government may force certain organizations to only use YMTC’s 3D NAND for their systems, which will guarantee stable demand, but it remains to be seen whether that demand will be significant enough to support the company economically.